Metrics are used in everyday practices across all industries as a measurement tool for major business elements. Metrics allow us to better understand current business processes, which leads to businesses making better decisions. These metrics supply insight to performance, assistance understanding issues and the ability to recognise trends. However, within Accounts Payable (AP) departments, metrics are usually overlooked due to the difficulty of obtaining data and are sometimes not truly appreciated by higher management or those outside of the department. Let us take you through some crucial metrics which businesses can use to measure overall performance and success from their Accounts Payable.

1. Average Cost per Invoice

Calculating your Average Cost per Invoice can be overlooked due to the difficulty and steps required to accurately calculate a dollar figure. However is a crucial metric as this may be where your largest cost could lie within your AP process. Not all invoices are treated the same, especially non-PO invoices that could be potentially costing you even more.

With our live dashboard, ProSpend will not only allow you to confidently track your metrics including Average Cost per Invoice – it has been proven to save up to 85% of the cost. You can speak with one of our specialists for an analysis on your Cost per Invoice – you’ll be surprised!

2. Average Processing Time per Invoice

The time it takes to process an invoice is a perfect way to identify areas that require improvement and where efficiencies can be introduced free up your staff’s time, allowing them to concentrate on more strategic and beneficial activities.

Enabling certain efficiencies through software, such as ProSpend, allows staff to access AP functionality (eg. Approvals) on their mobile devices that has been proven to cut time spent on invoices by over 80%. Jamie Hughes from Animals Australia mentions “We’ve reduced the time to process a supplier invoice approval and payment by a number of days, it’s visible to everyone and now paper-free.”

3. Late Payments & Discounts Captured

To encourage early payments, most suppliers offer exclusive discounts for payments that are made on time. Late Payments are usually not intentional, however manual processes hinder staff to take advantage of early payments and the discounts on hand due to constraints such failing to manually set up reminders and notifications. As we know, late payments do not only take away the chance of obtaining discounts – they are highly likely to incur additional late fees that are usually not accounted for.

Measuring Late Payments & Discounts Captured can identify reasons why these discounts are being missed and how the organisation can improve processes to boost company revenue. With real metrics, it can encourage your staff to pay on time, boosting supplier relationships whilst saving on invoice costs. Look to invest in cloud technology, such as ProSpend, that makes capturing Discounts seamless with live notifications and easily trigger timely payments.

4. ROI on Automation

Everyday, thousands of companies are taking advantage of AP Automation, which is the process of digitising and automating their existing manual AP processes. AP Automation does not only significantly reduce time and costs, but software such as ProSpend offers real-time visibility and transparency that higher management can use to drive strategic decision-making, leading to enhanced efficiencies and growth.

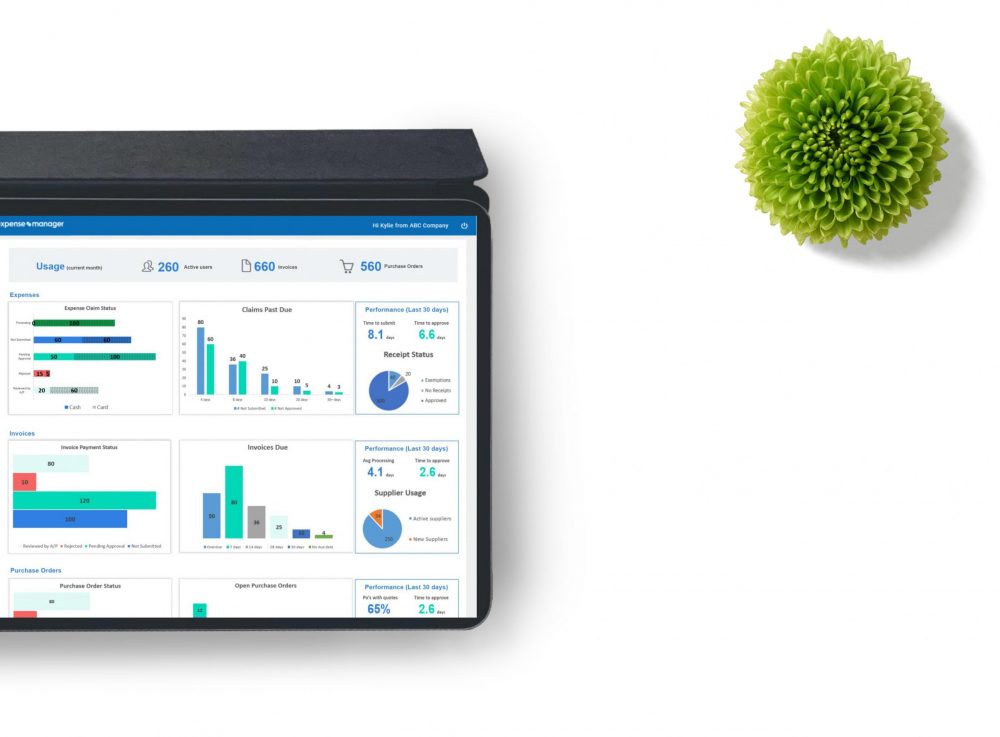

ProSpend offers a complete live dashboard that demonstrates key performance metrics, which can quickly demonstrate the total ROI on Automation. Gavin Finn from Peoplebank quotes “The ProSpend invoice module has automated our accounts payable process. As a result we have saved hard dollars in printing, filing, storage and man-hours. The return on our investment IS absolutely there!”

If you are curious to see what your business can save through AP Automation or are having difficulty presenting to your higher management the numerical justification, you can speak with one of our specialists for a consultation.

As we can see, Metrics are a crucial tool that are required to measure results and performance within AP departments to develop strategic and growth driven decisions. Whilst manually collating and monitoring your metrics is possible, this can add additional time that may not be easily available when you are manually processing Accounts Payable tasks.

Leading AP Automation & Expense Management software such as ProSpend allows you to understand, track and monitor your spend through powerful insights demonstrated in the form of a live dashboard. Analytics that are generated by digitised workflows assist you and higher management navigate the journey of efficient and successful processes.