FBT and Tax Management

Tax Management is made simple with ProSpend. Our tax wizard is designed for Australian FBT and GST as well as used globally with configurable tax options.

.png?width=760&height=760&name=ProSpend%20Website%203%20x%20Key%20Feature%20Images%20(4).png)

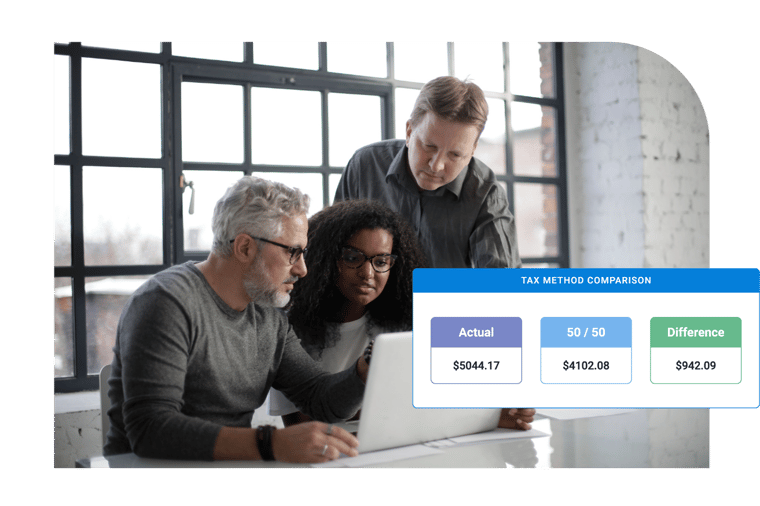

Real-time savings

Powerful tax management and reporting to compare the Actual or 50/50 method and savings that can be achieved

Detailed reporting

Detailed recipient information with FBT calculation for each.

Group legal entities

Group your legal entities to receive an entire view of FBT without having to manipulate reports in Excel.

Manage your FBT

Our tax management module gives businesses the ability to accurately track and record FBT calculations and linked expenses.

50/50 Method

The FBT 50/50 method calculates FBT on 50% of the total taxable value of fringe benefits incurred by providing meal entertainment during the FBT year.

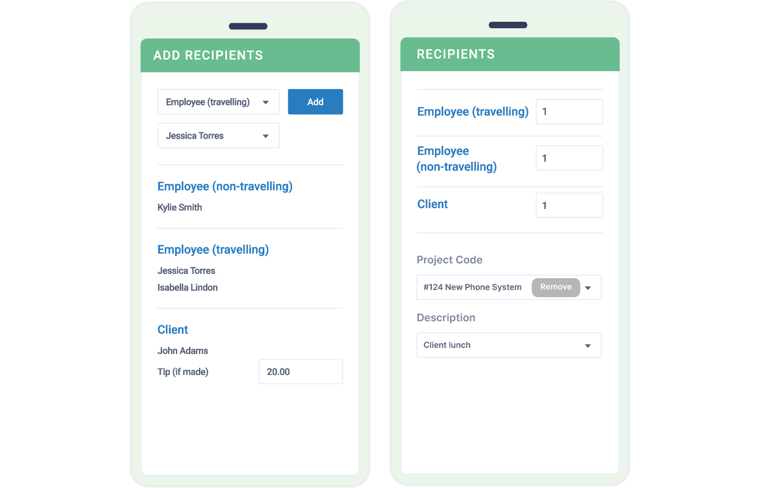

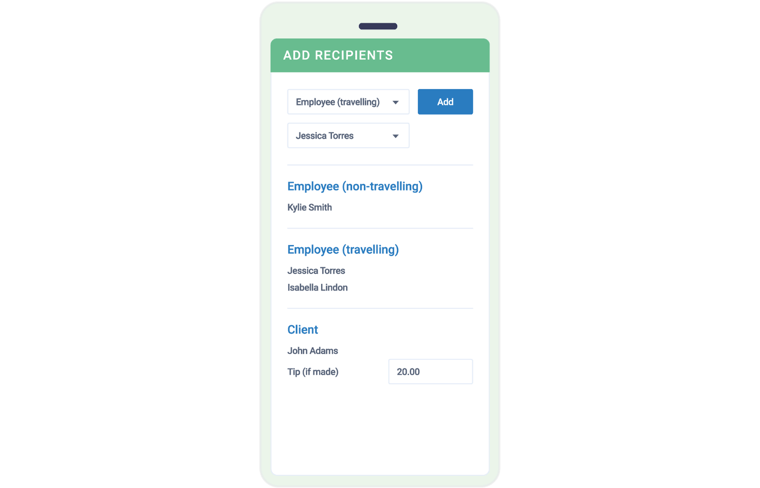

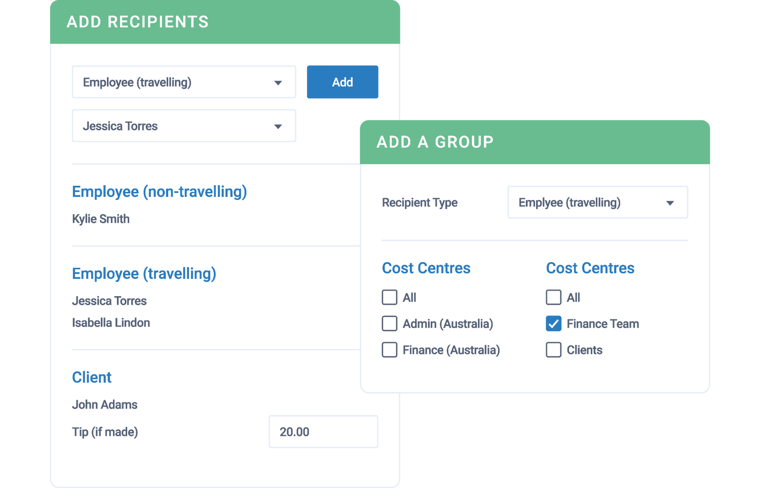

Actual Method

Our FBT wizard allows users to nominate the attendees with a smart wizard that calculates the FBT accurately

Add groups

Save any number of groups favourite FBT splits for easy update

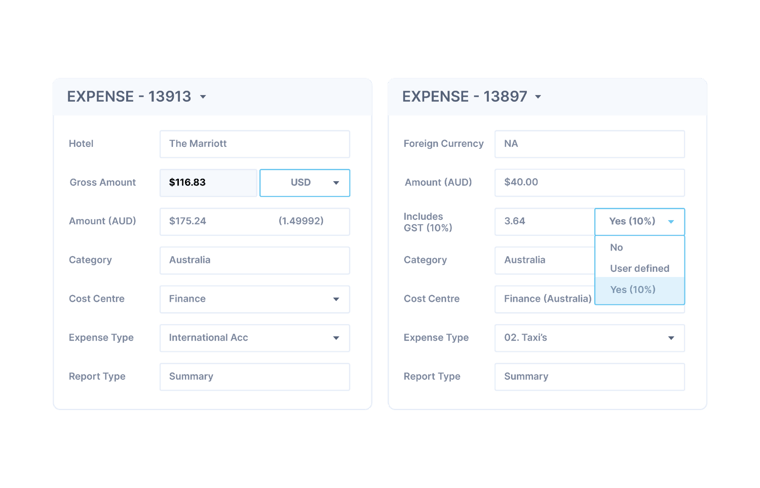

Multiple Tax Rates

Users can edit entire tax amount or apply different rates for different items in an expense

Track and Report

Real-time savings – Powerful tax management and reporting to compare the 50/50 or Actual method and savings that can be achieved.

Detailed reporting – Detailed recipient information with the FBT calculation for each.

Not just entertainment – Powerful configuration options to track multiple linked expenses, such as Gifts, Sustenance, etc.

Group legal entities – Group your legal entities to receive an entire view of FBT without having to manipulate reports in Excel.

Highly configurable

ProSpend (formerly expensemanager) can be used globally with configurable tax options. For our Australian users, it is fully configurable for Australian tax rules and regulations.

Need clarification?

Can we control or change budgets?

Yes, you can make any updates as your business priorities change.

How does reporting work in ProSpend?

ProSpend (formerly expensemanager) provides reporting at the user and budget owner levels.

How does budget module helps in forecasting?

You can assign budgets to projects or activities for forecasting and measurement of spend and full audit trail.

Can we add a budget module post Go-Live with other modules?

Yes, you can add any additional modules during the set up of your account or post Go live.

Is the budget module an add on?

Yes, you can take this module straight away or later.

How does the notifications for budgets work?

Email alerts are sent when limits are close or overspent.

One platform for all your business spend

Easily manage your spend, expenses, invoices, purchase orders and budgets all in one powerful solution.